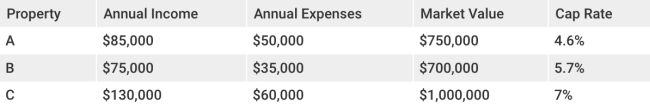

single family home cap rate

Risk profile: Returns on all real estate investments are directly related to the risk. The return on a Treasury bond, which is guaranteed by all the faith and credit of US Government, is very low. A junk bond, with a higher risk rating, higher return target, and a lower probability of default, is an alternative. A cap rate of less than 5% is often indicative of a lower risk profile in real estate. However, a cap rate greater than 7% is considered a more risky type investment. Investors will judge whether a caprate is "good", or "bad". This is because they are evaluating the return on investment against the risk. A Class A 98%-occupied multifamily home in San Francisco that is offered at a 3% rate may be purchased by an investor. This is different from a Class A single tenant office in Richmond which is offered at a 100% occupancy rate at 8%. Both are wrong. They reflect a differing risk profile and desire for lower risks and higher returns. The question real estate investors need to ask is "Does the caprate reflect the risk I'm willing to take?"