noi meaning real estate

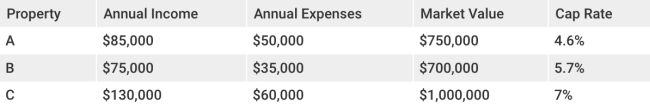

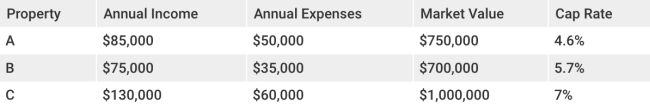

Cap rate formula is as simple as it sounds: It is simply the annual NOI divided with the market value. A cap rate of 5 percent would be applied to a property with a value of $10 million and $500,000 of NOI.

The capitalization rate or cap rate is one of the most common return metrics that are used to evaluate the performance of real estate investments.

Cap rates are often used in conjunction with bonds' coupon. Both can be used to pay a percentage off the asset's actual value.

Cap rate formula is as simple as it sounds: It is simply the annual NOI divided with the market value. A cap rate of 5 percent would be applied to a property with a value of $10 million and $500,000 of NOI.

In real estate investing, the "cap rate" refers to the unlevered rate for return on an asset based upon its annual net operating earnings (NOI).

Cap rates, which can be expressed as a percentage, represent returns for one point in time. They are used to evaluate individual properties or compare properties.

You can use the same cap rate formula to calculate the value of a building using its NOI. The example shows that if the property generates $500,000 of NOI and that the appropriate market cap rate (i.e. the unlevered returns) for similar projects in the same market is 5%, then you can divide $500,000 with 5% to calculate a $10,000,000 value. A project that generates $500,000 of NOI may be worth $8.3million if it has a market cap rate of 6%. This shows how shifting returns expectations in the marketplace (in the case of the cap rate) may cause implied real estate prices to fluctuate.

To minimize risk and maximize your returns when real estate investing, it is important to do your due diligence. Doing thorough research about the investment property you are considering purchasing is crucial before making any purchase. To make an informed decision about whether purchasing it is a wise move, you must learn how to run the numbers. While cap rates are a common way for investors to evaluate real estate deals and to make decisions, there isn't a clear answer to the question of "What is the best cap rate?"