1 percent rule real estate

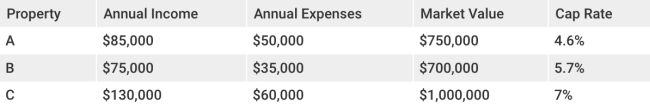

You should keep in mind that assets with solid monthly cash flows are unlikely to appreciate over time. A high capitalization rate in the area will typically produce large cash flows monthly but won't appreciate over time.