invisalign for adults

You can make use of a versatile spending account (FSA) or health and wellness savings account (HSA) to pay for Invisalign. Some companies offer an FSA program that you can pay into via pretax payroll reductions. One more choice is an HSA, if you have actually a certified high-deductible health insurance strategy. An HSA allows you set cash aside to spend for eligible medical, dental, as well as orthodontic expenses tax-free, yet, unlike an FSA, the funds do not expire after a year.

If you do not have an FSA or HSA, there's another means to obtain tax financial savings. You can deduct clinically needed oral and also orthodontic costs like Invisalign from your income tax return-- as long as they surpass 7.5% of your modified gross income. So, conserve all your receipts.

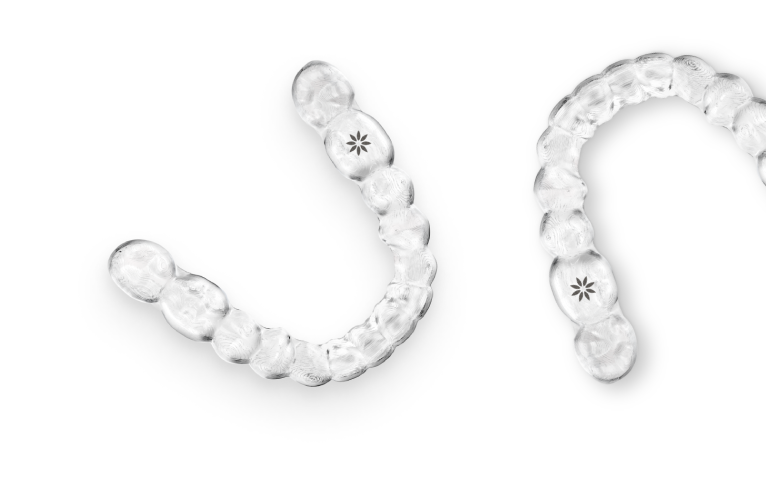

How does Invisalign work? A dental professional or orthodontist does a preliminary examination to see if you are an excellent prospect for Invisalign or if typical dental braces-- wire and also brace devices taken care of to the teeth-- would be better for you.