Auto Insurance Coverage in Las Vegas NV

Liability Insurance Requirements in Las Vegas

Car insurance is a compulsory requirement for each vehicle driver in Las Vegas, Nevada. The condition legislation needs every vehicle manager to have a valid insurance policy that deals with bodily injury and also property damage liability just in case of an accident. Liability insurance aids secure the car driver, their travelers, and any various other person or vehicle entailed in the accident. Choosing the right insurance coverage for your vehicle is actually a critical choice, as it makes sure financial protection just in case of unforeseen activities when driving. Failing to abide by the insurance requirement can easily cause penalties, fines, or perhaps suspension of driving benefits.

When acquiring car insurance in Las Vegas, drivers have the option to select between minimal liability coverage or even extra comprehensive coverage. Lowest liability coverage provides essential protection versus bodily injury and also residential property damage triggered by the insured vehicle driver in an at-fault accident. On the contrary, comprehensive coverage gives a greater stable of protection, featuring protection for damage brought on by elements such as fraud, vandalism, or all-natural catastrophes. It is actually crucial for car drivers to meticulously review their insurance policy and comprehend the coverage given through their insurer to guarantee they are sufficiently defended while driving in the bustling city of Las Vegas.

The amount of does car insurance cost in Las Vegas?

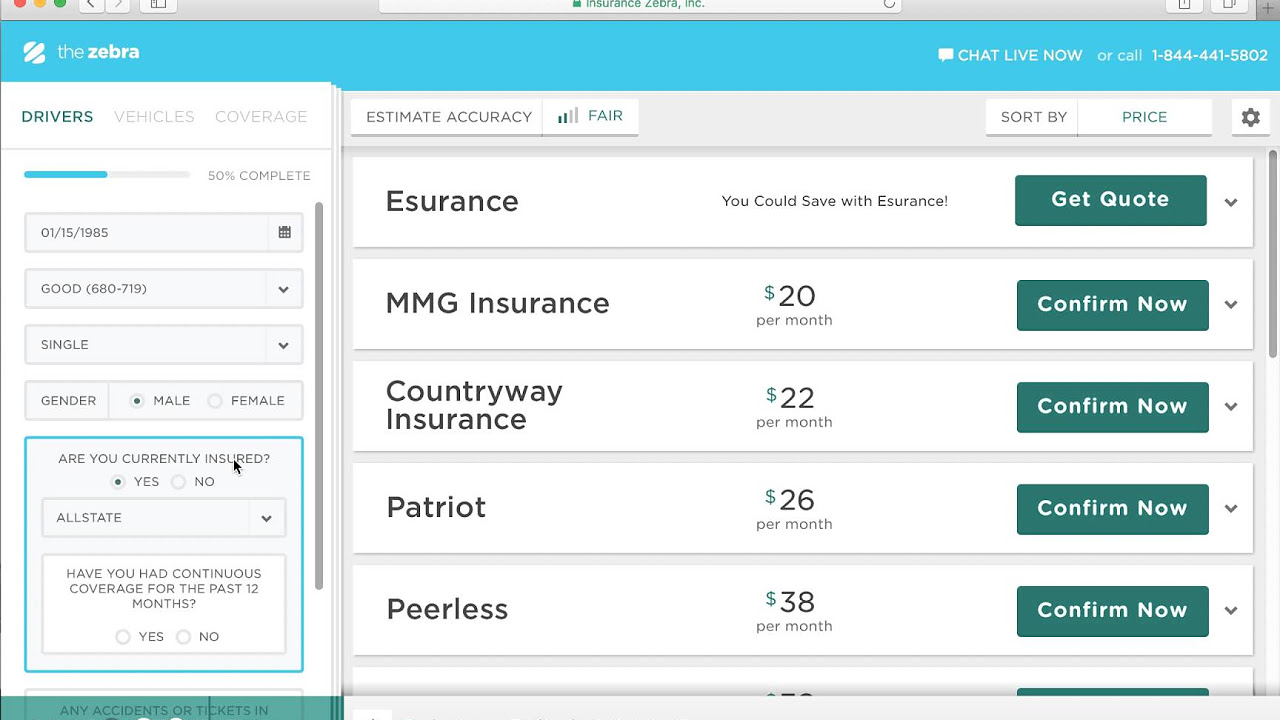

Car insurance prices in Las Vegas can easily vary relying on many variables. Auto insurer in the location consider a series of variables when figuring out prices for drivers. These may feature driving record, coverage limits, bodily injury liability, property damage liability coverage, and also coverage options like complete and also crash insurance coverage. The average cost of car insurance in Las Vegas is higher than the national average, which can be actually credited to the special web traffic states as well as driving habits in the city.

For teen drivers, the expense of car insurance can be considerably higher as a result of their absence of expertise when traveling. In Las Vegas, insurance rates for teen vehicle drivers are actually had an effect on through elements like the form of vehicle they drive, their driving record, and the volume of protection on their auto policy. It is recommended for moms and dads to look into different options to discover affordable car insurance for their teen car drivers, including bundling insurance plans or installing a telematics Las Vegas device to possibly lower insurance rates. Companies like Geico supply quotes that take in to factor to consider several factors to provide individualized protection for car drivers in Las Vegas.

Las Vegas car insurance discounts

In Las Vegas, auto insurance discounts can assist vehicle drivers spare money on their insurance costs. Numerous insurer offer rebates for several factors including having an excellent driving record, being a student along with great levels, or bundling a number of insurance plans with each other. Through making use of these discounts, motorists may lower their auto insurance rates and find cheap car insurance that suits their finances.

One more method to possibly lower your auto insurance rate in Las Vegas is actually by keeping continuous insurance coverage. Insurance business frequently deliver markdowns to car drivers that possess a record of dependable auto insurance coverage with no blunders. Through showing proof of insurance as well as demonstrating accountable actions behind the tire, drivers can receive reduced insurance fees. Additionally, some insurance firms might deliver exclusive discounts for sure teams, such as female motorists or even pupils, so it costs consulting your insurance agent to see if you obtain any kind of additional discounts on your monthly premium.

Ordinary car insurance in Las Vegas through rating factor

One vital variable that affects the typical car insurance rates in Las Vegas is actually the type of vehicle being insured. Insurance providers take note of the make, design, and also grow older of the vehicle when establishing fees. As an example, guaranteeing a high-end cars will typically possess higher premiums reviewed to a regular sedan. The amount of protection picked also influences the cost, along with comprehensive coverage being even more pricey than simple liability coverage.

An additional essential part that determines normal car insurance rates in Las Vegas is the driving background of the insurance holder. Responsible car drivers along with clean driving documents are actually usually entitled for safe car driver discounts, which can result in reduced superiors. On the contrary, people with a record of incidents or traffic transgressions might encounter greater rates as a result of being actually identified as greater danger by insurer. Moreover, grow older may additionally participate in a notable function in insurance rates, as 20-year-old motorists are commonly looked at riskier to guarantee reviewed to a 35-year-old motorist. Insurance carriers bear in mind numerous aspects including the rates of accidents including younger motorists, conformity with teen driving laws, as well as overall driving habits when finding out fees.

Why is car insurance in Las Vegas so pricey?

Car insurance in Las Vegas is actually particularly expensive because of several providing factors. One substantial part is the eligibility requirements specified by auto insurers, which can easily influence the expense of protection. In Nevada, minimum coverage requirements vary around cities like Boulder City, Carson City, and Las Vegas, with major cities commonly imposing much higher criteria. Also, factors like financial strength ratings and rating factors may affect superiors. It is actually necessary for vehicle drivers to think about elements including bodily injury liability, uninsured motorist coverage, as well as underinsured motorist coverage when evaluating coverage levels, as these components may considerably impact the general cost of insurance.

Moreover, the addition of added functions like anti-theft gadgets and also choosing rebates, like those for full time pupils, can also influence the expense of insurance in Las Vegas Executing digital policy management resources and also exploring options for student markdowns may supply financial protection while possibly lowering fees. Auto insurers in Las Vegas usually servile sample rates on several factors, including coverage levels and also private scenarios. Through watching regarding satisfying minimal needs and also looking into offered discounts, motorists in Las Vegas can easily find means to create car insurance a lot more affordable without weakening vital coverage.

Packing insurance plans in Las Vegas

When it pertains to packing insurance plan in Las Vegas, insurance policy holders may unlock several discount opportunities through mixing various insurance products under one service provider. This technique not just simplifies the insurance method yet also often results in cost discounts. In Las Vegas, insurance provider typically use discounts for packing automotive and home insurance, allowing individuals to profit coming from affordable rates while making certain comprehensive coverage around various aspects of their life.

Besides reduced yearly fees, bundling insurance coverage in Las Vegas may likewise streamline management jobs by merging all plans right into one effortlessly available electronic format. Whether it's taking care of a slight fender bender or even evaluating coverage options, possessing all insurance details in one place may be beneficial and also efficient. Additionally, packing can easily help prevent a lapse in coverage, making certain people possess continual protection across different insurance styles including bodily injury coverage, medical payments coverage, as well as additional coverages at the most affordable rate achievable.

What are actually the liability insurance demands in Las Vegas?

In Las Vegas, vehicle drivers are needed to have liability insurance coverage of a minimum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and also $20,000 for residential property damage.

Just how much carries out car insurance cost in Las Vegas?

The cost of car insurance in Las Vegas can differ depending on elements such as your driving record, grow older, the type of auto you drive, as well as the insurance company you pick. Usually, vehicle drivers in Las Vegas pay out around $1,400 each year for car insurance.

What are actually some auto insurance discounts accessible in Las Vegas?

Some popular auto insurance discounts offered in Las Vegas include multi-policy savings for packing numerous insurance plan, safe car driver discounts, as well as discounts for having actually anti-theft gadgets mounted in your auto.

What is actually the common car insurance in Las Vegas through rating factor?

The common car insurance in Las Vegas can vary through rating factor, but factors including grow older, driving record, and also sort of vehicle steered can all impact the price of insurance.

Why is actually car insurance in Las Vegas therefore costly?

Car insurance in Las Vegas could be more pricey than in other regions because of aspects including a higher cost of mishaps, fraud, as well as hooliganism in the city, in addition to the cost of living as well as insurance regulations in Nevada.

Exactly how can bundling insurance plan in Las Vegas aid spare money?

Packing insurance plan in Las Vegas, including blending your vehicle as well as home insurance with the same company, can frequently lead to savings coming from the insurance company, eventually helping you save money on your total insurance costs.